Retinal Vein Occlusion at a Crossroads: Targeting Durability, Safety, and Global Access | Competitive Intelligence

Explore the evolving RVO treatment landscape from anti-VEGF breakthroughs to pipeline innovations addressing unmet needs in efficacy, safety, and dosing burden.

AUSTIN, TX, UNITED STATES, June 18, 2025 /EINPresswire.com/ -- Retinal Vein Occlusion (RVO): A Market on the Edge of Therapeutic Transformation

Retinal Vein Occlusion (RVO) , the second most prevalent retinal vascular disease after diabetic retinopathy, is gaining renewed attention in the global ophthalmology market. Characterized by the blockage of retinal veins, RVO disrupts normal blood flow, leading to retinal hemorrhages, macular edema, and, ultimately, vision loss. Affecting nearly 28 million individuals worldwide—primarily those over 60 years of age—RVO remains a pressing public health issue and a growing market opportunity.

RVO exists in two primary forms: Central Retinal Vein Occlusion (CRVO), involving the main vein of the retina, and Branch Retinal Vein Occlusion (BRVO), which affects smaller peripheral branches. Both subtypes can cause acute and chronic vision impairment if not promptly and adequately managed.

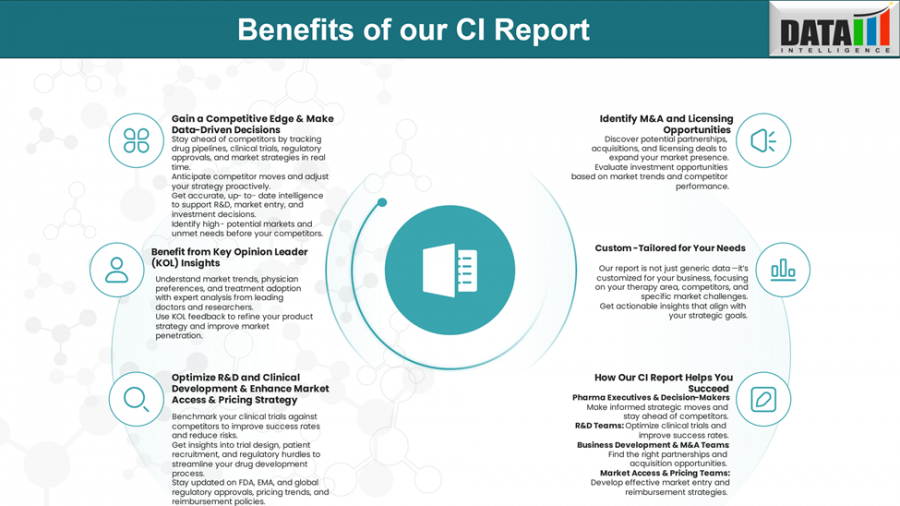

Download CI Sample Report: https://www.datamintelligence.com/strategic-insights/ci/retinal-vein-occlusion-rvo

A Look at the Epidemiology

The incidence of RVO rises sharply with age, comorbidities such as hypertension and diabetes, and systemic vascular diseases. Japan alone reports approximately 1.66 million RVO cases, reflecting the higher prevalence in aging populations. With life expectancy increasing globally, the RVO patient pool is projected to expand considerably through 2033, particularly in countries with rapidly aging demographics like the U.S., Japan, South Korea, and parts of Europe.

Treatment Landscape: Current Standard of Care and Limitations

Modern RVO management primarily revolves around intravitreal anti-VEGF therapies and corticosteroid implants, aimed at reducing macular edema and preserving vision. The major FDA-approved treatments include:

- Ranibizumab (Lucentis) – Genentech’s anti-VEGF therapy, requiring monthly injections.

- Aflibercept (Eylea) – Regeneron/Bayer’s VEGF-trap, commonly administered every 4–8 weeks.

- Faricimab-svoa (Vabysmo) – Roche’s bispecific antibody targeting both VEGF-A and Ang-2, enabling longer dosing intervals.

- Dexamethasone Implant (Ozurdex) – A corticosteroid that offers sustained anti-inflammatory relief but carries risks such as cataract formation and elevated intraocular pressure.

These therapies, while effective, often require frequent injections, resulting in substantial burden for patients and healthcare systems. Additionally, treatment response is highly variable, especially in ischemic RVO cases, prompting an urgent need for new modalities that offer durable efficacy, lower risk, and fewer clinical visits.

Pipeline Innovation: Looking Beyond VEGF

The future of RVO treatment is rapidly evolving, with the pipeline featuring several promising candidates that aim to fill existing therapeutic gaps.

- KSI-301 (Tarcocimab Tedromer) by Kodiak Sciences is designed to extend the dosing interval beyond six months, directly addressing treatment fatigue.

- RGX-314 by Regenxbio is an investigational gene therapy targeting retinal diseases, potentially offering one-time administration with sustained benefits.

- Combination therapies and agents that modulate inflammation or target novel pathways are also in clinical development, moving the field toward precision and long-term control.

The key differentiator among emerging therapies lies in their mechanism of action and durability. While most current options act via VEGF inhibition, next-generation drugs aim to combine or bypass this pathway entirely to improve response rates and reduce resistance.

Market Outlook: Growth Trajectory Through 2033

In 2024, the global RVO therapeutics market was valued at approximately $2.6 billion. With an expected CAGR of 6–7%, the market is poised to cross $4.5 billion by 2033. This robust growth is fueled by:

- Rising disease prevalence due to global aging trends.

- Expanding access to biosimilars and cost-effective alternatives.

- Launch of longer-acting therapies reducing overall treatment burden.

- Strategic collaborations among biotech firms, payers, and governments to increase drug affordability and adherence.

High-growth regions include the Asia-Pacific and Latin America, where unmet needs in ophthalmology infrastructure and patient awareness are gradually being addressed through public-private partnerships.

Competitive Landscape: Established Leaders and New Challengers

Market Leaders:

- Regeneron/Bayer (Eylea & Eylea HD): Dominant player due to broad usage and physician familiarity.

- Roche/Genentech (Vabysmo): Gaining market share rapidly with its bispecific platform offering longer intervals.

- Biosimilar Providers (Samsung Bioepis, Sandoz, Amgen): Making inroads into mature markets with price-competitive alternatives.

Emerging Players:

- Kodiak Sciences (KSI-301): Focused on ultra-long durability.

- Adverum, Regenxbio: Betting big on one-time gene therapy solutions that could disrupt conventional injection-based regimens.

The landscape is becoming increasingly dynamic, where innovation in drug delivery and disease modification are becoming as critical as efficacy.

Unmet Needs: What the Market Still Demands

Despite available options, multiple therapeutic gaps remain:

- Durability: Current anti-VEGF therapies require monthly or bi-monthly injections, straining adherence.

- Non-responders: A subset of patients shows inadequate response to VEGF inhibition alone.

- Side Effects: Corticosteroid-based therapies pose risks of cataracts and glaucoma.

- Affordability: High treatment costs continue to hinder access, especially in developing regions.

- Comorbidity Integration: Systemic risk factors like diabetes and hypertension are often unmanaged in RVO care pathways.

Book Your Free CI Consultation Call: https://www.datamintelligence.com/strategic-insights/ci/retinal-vein-occlusion-rvo

Emerging therapies must address these challenges to capture meaningful market share and improve long-term outcomes.

Target Opportunity Profile (TOP): What an Ideal Therapy Looks Like

The next generation of RVO therapeutics should ideally combine the following attributes:

- Extended Dosing Interval: ≥6 months between doses.

- Multi-target Mechanism: Dual inhibition (e.g., VEGF + Ang-2) or novel pathways like inflammation modulation.

- Minimal Side Effects: No significant impact on intraocular pressure or lens clarity.

- Broad Efficacy: Works in both ischemic and non-ischemic RVO.

- Cost-Efficient: Competitive pricing and favorable reimbursement policies.

- Systemic Integration: Compatibility with systemic management for comorbid conditions.

Companies aligning their pipeline to this profile stand to benefit from both clinical and commercial success in a growing market.

Final Thoughts: A Vision for the Future

Retinal Vein Occlusion is no longer a stagnant corner of the retinal disease spectrum. With continuous innovation in biologics, gene therapy, and targeted drug delivery, the RVO market is entering a phase of robust growth and diversification. The focus is clearly shifting from not just preserving vision but doing so with fewer injections, less burden, and more patient-friendly options.

Strategic stakeholders—be it developers, payers, or providers—must now look beyond short-term efficacy and embrace a holistic, personalized approach to maximize patient outcomes and market penetration. As 2033 approaches, the next frontier in RVO care lies in merging science, access, and long-term vision sustainability.

Read Related CI Report:

1. Dermatomyositis | Competitive Intelligence

2. Chronic Rhinosinusitis with Nasal Polyps | Competitive Intelligence

Sai Kumar

DataM Intelligence 4market Research LLP

+1 877-441-4866

email us here

Visit us on social media:

LinkedIn

X

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release