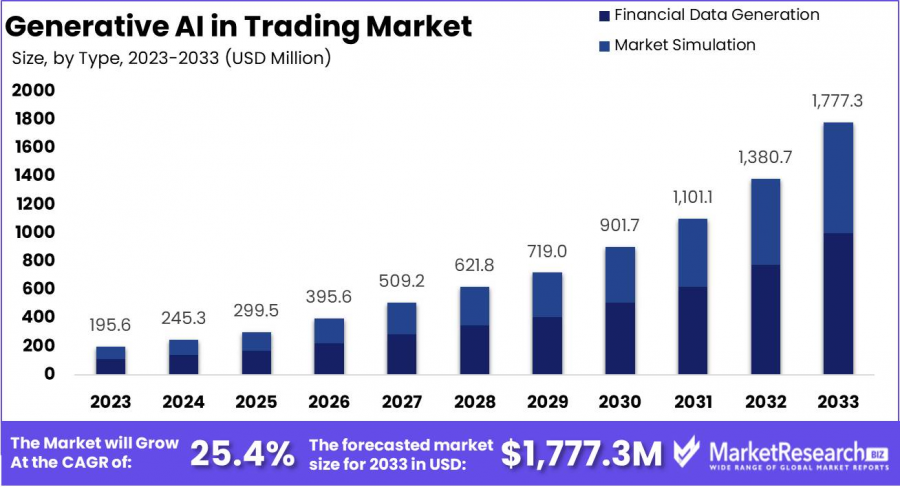

Generative AI in Trading Market Boosts Algorithm Predictions By USD 1,777.3 Million by 2033, CAGR at 25.4%

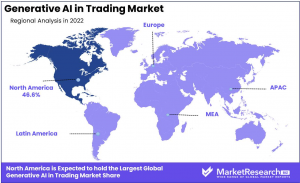

Regional Dominance: North America dominates with 46.6% in the Generative AI trading market...

NEW YORK, NY, UNITED STATES, January 31, 2025 /EINPresswire.com/ -- The Generative AI in Trading Market is projected to expand significantly, with a market size expected to climb from USD 195.6 million in 2023 to approximately USD 1,777.3 million by 2033. This demonstrates a robust CAGR of 25.4%.

The key factors driving this growth include the rising adoption of advanced technologies and the automation of trading processes. Generative AI fundamentally assists traders by examining historical financial data, synthesizing investment strategies, and automating stock purchasing and trading with high efficiency.

This technology utilizes intricate algorithms to analyze vast amounts of data and implement trades at optimal prices, ensuring accuracy in market forecasts and enhancing return on investments.

🔴 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://marketresearch.biz/report/generative-ai-in-trading-market/request-sample/

Firms use tools like machine learning, algorithmic predictions, and sentiment analysis to navigate financial markets efficiently, thereby reducing research time and operational costs. These advancements are facilitating the expansion of generative AI applications in trading, driven by increasing interest in stock trading across global markets.

Key Takeaways

Market Growth: The Generative AI in Trading Market was valued at USD 195.6 million in 2023. It is expected to reach USD 1,777.3 million by 2033, with a CAGR of 25.4% during the forecast period from 2024 to 2033.

By Type: Optimizing portfolios with AI maximizes returns, and minimizes risks efficiently.

By Application: Financial data generation AI drives market insights, enhancing investment strategies.

By Deployment: On-premises deployment emphasizes data control, security, and customized integration.

Regional Dominance: North America dominates with 46.6% in the Generative AI trading market.

Growth Opportunity: Generative AI revolutionizes trading strategies and personalizes wealth management.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://marketresearch.biz/purchase-report/?report_id=38991

Experts Review

Government incentives, coupled with technological breakthroughs, are crucial in advancing the generative AI trading sector. While investments present favorable prospects, they also include risks such as data integrity and adherence to evolving regulatory norms. Leading companies like Numerai LLC and OpenAI drive innovation by deploying AI algorithms that boost trading precision and efficiency.

The impact of this technology is significant, facilitating detailed market analysis and fostering adaptive strategic planning within the volatile trading environment. Consumer awareness is growing, creating a demand for AI solutions that enhance decision-making and investment outcomes.

However, the regulatory landscape poses challenges as it seeks to balance innovation with ethical considerations, ensuring data protection and transparency in AI deployment. Overall, the integration of generative AI into trading paves the way for a transformative future, offering more resilient and responsive trading strategies.

🔴 𝐕𝐢𝐞𝐰 𝐏𝐃𝐅 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐒𝐚𝐦𝐩𝐥𝐞 @ https://marketresearch.biz/report/generative-ai-in-trading-market/request-sample/

Report Segmentation

The market report on Generative AI in Trading is structured by type, application, and deployment methods. The type category includes Financial Data Generation and Market Simulation, focusing on offering predictive and analytic capabilities for enhanced trading outcomes.

Applications are segmented into Portfolio Optimization, Trading Strategy Development, and Risk Assessment and Management, reflecting the diverse usage of generative AI in improving financial decision-making processes. Deployment options include On-Premises, Cloud-Based, and Hybrid models, catering to varying organizational needs in data security and system integration.

Geographical segmentation covers North America, Europe, Asia-Pacific (APAC), Latin America, and the Middle East & Africa, each exhibiting unique adoption rates and integration levels of AI technologies. This comprehensive segmentation helps stakeholders identify key growth areas and tailor strategies to maximize market penetration and technological advancement in different regions.

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://marketresearch.biz/purchase-report/?report_id=38991

Key Market Segments

Based on Type

Financial Data Generation

Market Simulation

Based on Application

Portfolio Optimization

Trading Strategy Development

Risk Assessment and Management

Based on Deployment

On-Premises

Cloud-Based

Hybrid

Drivers, Restraints, Challenges and Opportunities

The surge in demand for sophisticated trading tools drives the growth of generative AI in the trading market. The ability to generate and analyze artificial financial datasets enhances the robustness of predictive models, allowing traders to gain critical insights into market dynamics. However, restraints include the necessity for large and high-quality datasets alongside the complexities inherent in financial markets.

Challenges are notably marked by the intricacies of integrating AI models into existing trading frameworks while ensuring data accuracy and security. Despite these hurdles, significant opportunities arise from the need to optimize trading strategies and enhance risk management protocols. The continual evolution of AI technologies opens avenues for developing innovative financial solutions that transform traditional trading paradigms.

Utilizing generative AI for personalized trading and investment strategies not only meets the current market demands but also prepares the investment community for future challenges, ensuring a sustainable competitive edge in the financial sector.

Key Player Analysis

Prominent companies in the Generative AI in Trading Market include Numerai LLC, OpenAI LP, Kavout Inc., Aidyia Holdings Ltd., and Sentient Technologies Holdings Ltd. Numerai LLC’s approach to crowdsourcing predictive market models emphasizes innovative financial strategies, utilizing insights from a global network of data scientists.

OpenAI is recognized for its advanced AI capabilities that analyze vast financial datasets, providing high-speed, actionable insights for trading. Kavout Inc. leverages its machine learning system, the K Score, to evaluate stock investments, enhancing decision-making processes with advanced analytics.

Aidyia Holdings and Sentient Technologies focus on AI-driven hedge funds, deploying algorithms to forecast market movements with remarkable accuracy. Collectively, these key players are propelling the market forward, setting benchmarks for AI integration in trading, and offering tools that empower market participants to navigate the complexities of the financial landscape with confidence and strategic foresight.

Top Key Players in Generative AI in Trading Market

Numerai LLC

OpenAI LP

Kavout Inc.

Aidyia Holdings Ltd.

Sentient Technologies Holdings Ltd.

Pecan AI Ltd.

Other Key Players

Recent Developments

Recent developments in the Generative AI in Trading Market highlight significant advancements in data analysis and market simulation. In 2024, discussions among industry leaders like Deutsche Bank and Google emphasized the transformative potential of generative AI in improving trading outcomes through innovation and ethical practices.

Technological improvements such as the development of Scotty AI demonstrate the surge in AI applications within the cryptocurrency trading sector, leveraging AI to offer enhanced capabilities in the digital financial market. Companies like Imperative Execution continue to refine AI-based trading with in-house solutions such as IntelligentCross, which ensures robustness in trade execution and analysis.

These advancements reflect a broader trend towards AI-driven trading environments that are more efficient and responsive to market shifts, solidifying generative AI's role as a critical component of modern trading strategies and financial technology solutions.

Conclusion

The Generative AI in Trading Market is set for substantial growth, fueled by technological advancements and increasing reliance on AI-driven trading solutions. While challenges related to data quality and regulatory compliance persist, the benefits of enhanced analytical capabilities and optimized trading strategies present a compelling case for widespread adoption.

As key industry players innovate and refine AI applications, the market is poised to revolutionize traditional trading practices, offering a more dynamic and effective approach to navigating financial markets globally. The continued integration of generative AI promises significant advancements in trading precision, efficiency, and strategic foresight, ensuring a competitive market edge.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

AI Image Enhancer Market - https://marketresearch.biz/report/ai-image-enhancer-market/

Generative AI in Capital Market - https://marketresearch.biz/report/generative-ai-in-capital-market/

Independent Software Vendors (ISVs) Market - https://marketresearch.biz/report/independent-software-vendors-isvs-market/

In-App Purchase Market - https://marketresearch.biz/report/in-app-purchase-market/

Generative AI in Construction Market - https://marketresearch.biz/report/generative-ai-in-construction-market/

Generative AI in Private Equity Market - https://marketresearch.biz/report/generative-ai-in-private-equity-market/

Televisions Market - https://marketresearch.biz/report/televisions-market/

Large Format Display (LFD) Market - https://marketresearch.biz/report/large-format-display-lfd-market/

Agricultural Drone Market - https://marketresearch.biz/report/agricultural-drone-market/

Privileged Access Management Solutions Market - https://marketresearch.biz/report/privileged-access-management-solutions-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release